As climate change accelerates, hurricanes, wildfires and hailstorms are hitting the US with increasing force – and the insurance market is struggling to foot the bill for the damage they leave behind for customers.

In 2023 alone, extreme weather cost the US more than $92 billion. And it’s not just home insurance providers that are raising rates.

Now car insurance quotes reflect trends seen across the home insurance market as climate change becomes an increasingly common – and costly – factor.

This can cause trouble for car owners, experts say. Vehicles are an important means of escape during a climate-driven disaster, but they can also fall victim to floods and fires just like houses.

Primary and secondary hazards

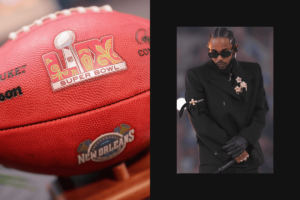

When Hurricane Helene cars swept across the southern US in early October drifted down streets like boats as floodwaters submerged entire neighborhoods. Other vehicles were crushed by felled trees or flying debris.

Most car insurance plans cover flooding and this external damage to help people recover from their losses. The Palm Beach Post reports that Floridians have filed more than 90,000 auto insurance claims since hurricanes Helene and Milton.

The bad news is that increasing hurricane intensity forces insurance companies to raise rates to account for future payouts. And it’s not just megastorms that have the auto insurance market reeling, according to Andrew Hoffman, a professor of sustainable enterprise at the University of Michigan.

“We can talk about the big storms like Helene and Milton, but it’s really the secondary hazards that cause more payouts. And it’s heavy rainstorms [and] flash flood that comes with it,” Hoffman told me. Other such hazards may include hailstorms, droughts and wildfires – all fueled by climate change.

“It’s actually secondary perils that really have a dominant influence in driving up insurance costs,” he added.

An August report found that the average American car insurance policy could increase by 22 percent by the end of this year. This is due to a number of factors, including inflation, extreme weather, and more cases of serious accidents or dangerous driving. The report found that rates in California, Missouri and Minnesota could increase by as much as 50 percent, and that “damage from severe storms and wildfires are contributing to rising rates in the states.”

In 2023, the insurance company Allstate threatened to stop renewing auto policies in several states until governments agreed to higher rates, The Wall Street Journal reports. The problem is much worse in the home insurance market. In March, my colleague Amy Green wrote about homeowners struggling with astronomical home insurance premiums in Florida, where climate shocks are upending the state’s entire real estate market. Florida now has the third highest car insurance rates also in the country.

“Many of the things that apply to the weather effects on home insurance also apply to the car sitting in your driveway,” Hoffman said.

Globally, only part of the cost of natural disasters is covered by insurance companies: Insurers and reinsurers paid $95 billion of the $250 billion in economic losses last year, according to Munich Re.

Ripple market effects

After the recent back-to-back hurricanes were rental car agencies overrun with customers waiting for repairs to their own vehicles. Those with totaled cars turned to local dealerships to find a new ride — but some of these businesses couldn’t escape the storms’ paths of destruction either. For example, one dealership in New Port Richey, Florida, lost an estimated 672 vehicles during Hurricane Helene. Although the business’s cars were insured and the manufacturer sent new ones to meet demand, the dealer’s owner said he would have to pay about $3.5 million to cover copayments.

Demand and prices for new and used cars often rise after hurricanes. So is the risk for scams, experts say. A recent report of the automotive data company Carfax estimates that as many as 138,000 vehicles experienced flood damage in six states during and after Hurricane Helene. The company has warned that thousands of these vehicles are likely to be purchased and cleaned by fraudulent salespeople, who target customers unaware of the ongoing internal damage, the company says. Similar scams took place in the aftermath of Hurricane Katrina in 2005.

“After cleaning the cars and moving them across the country, these scammers will try to trick unsuspecting buyers into thinking they’re getting a great deal,” Faisal Hasan, the vice president of data at Carfax, said in a statement. “These cars may look fresh in the showroom, but they are literally rotting from the inside.”

Last week, the Attorney General of Illinois, Kwame Raoul issued a warning for consumers that these flood-damaged vehicles could soon enter the state’s used car market because they are “often shipped to locations hundreds of miles from storm-battered areas.”