Then President Joe Biden signed the Inflation Reduction Actor IRA, became law two years ago, a starting gun sounded. “The race is on,” said Jacob Corvidae, a senior principal at the Rocky Mountain Institute (RMI), a clean energy think tank, for states to attract and encourage the private actions that will boost their economies. forefront of the clean economy. , and capture the tax incentives in the IRA that spur those investments.

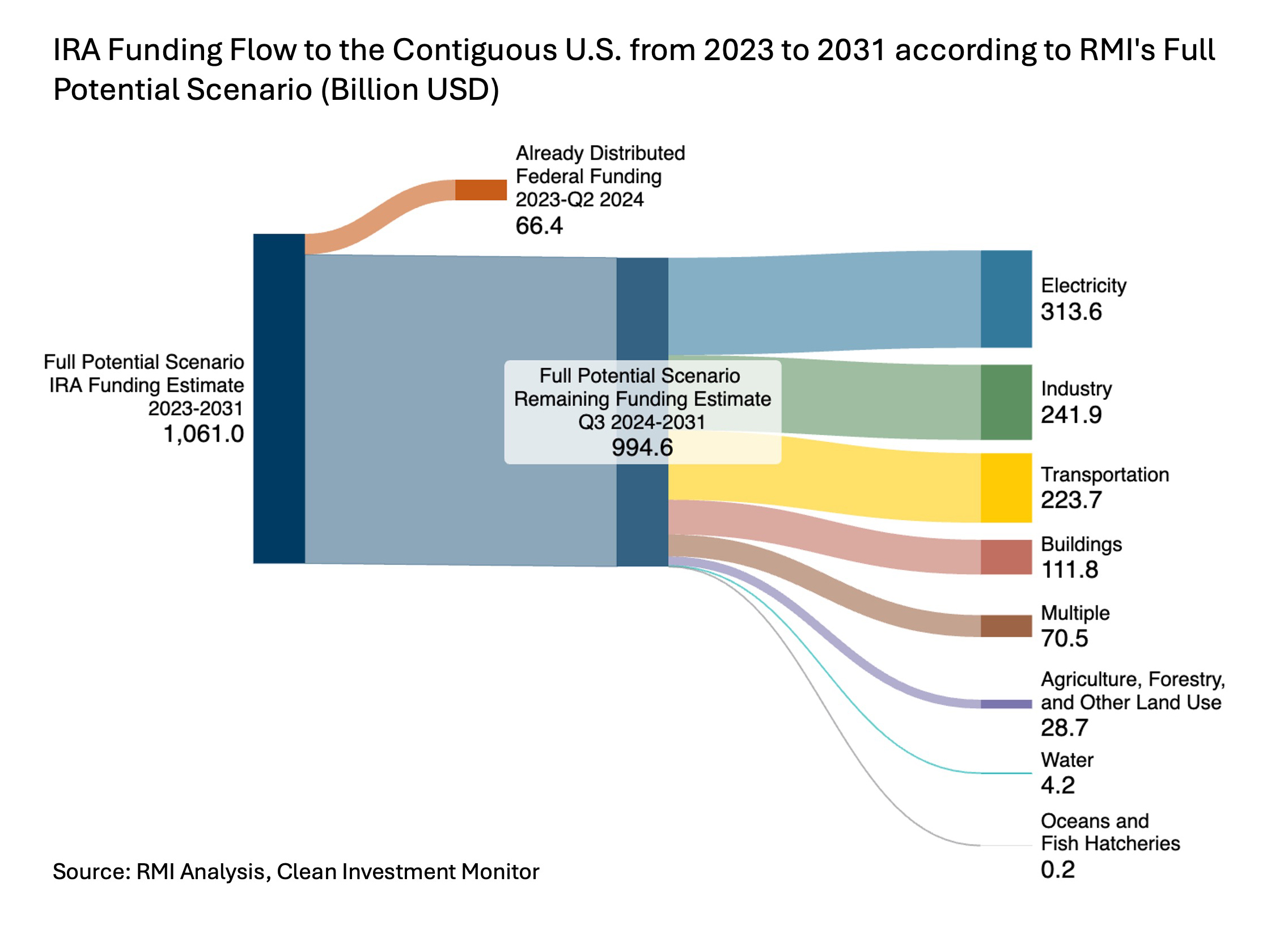

According to a new report from RMIwho co-authored Corvidae started that race slowly. Corvidae and his team estimate that the federal government will need to invest about $1 trillion in local economies through tax incentives by 2031 for the country to meet its clean energy goals. So far, through June 2024, the Feds have distributed $66 billion — or about 6 percent of the full spending required by our climate commitments.

There is no upper limit on the amount of IRA tax credits the government can hand out each year, so the federal money that goes back to states in tax incentives each year is largely a reflection of the amount of private clean energy investment in their economies. It also means that much more money has been invested in the clean energy transition than $66 billion dollars – in fact that figure has been matched and multiplied fivefold by private investment.

Rocky Mountain Institute / Clean Investment Monitor

The RMI report looked specifically at how well each state captured federal tax incentives, compared to estimates of their full funding potential. States in the contiguous US received an average of 7 percent of the total funding they need to reach their full potential by 2031, but that number varies widely. California and Texas lead the nation in the amount of tax breaks received so far — California claimed $13 billion and Texas $9 billion. Both states have emerged as leaders in the clean energy economy. But, according to the RMI estimates, both are also still far from their full potential, with Texas capturing only 6 percent of its full potential for funding, despite its clean energy growth. At 11 percent, California is at the higher end for the nation.

Some of the states that received the least federal funding through IRA tax incentives include West Virginia, at less than 1 percent of its potential and just over $120 million, and Louisiana, also under 1 percent at just under $400 million . Idaho, Delaware and Vermont each have yet to claim even $100 million in IRA incentives, at 2 percent, 2 percent and 6 percent, respectively.

Covidae attributes the slow start to a necessary and expected ramp-up period. The report notes, “The use of the tax credits has just begun, so it makes sense that these numbers (for almost all states) are currently low.” Although it also makes clear that most states are not on track to reach their full potential from federal funding. Businesses and families are still figuring out how to take advantage of what exists, so the states that were best able to quickly seize the opportunities are these (California, for example) that had a head start, with markets for solar and electric vehicles already starting to mature – or, like Georgia, where they could attract large industrial investments.

However, although overall funding from tax incentives is lower than expected, individual households are trending above forecasts, according to IRS data cited in the report. Four times as many families as expected benefit from the residential tax credits.

For Corvidae and the report’s co-authors, the point of tracking this information is to help states understand where their potential lies, and how to encourage clean energy adoption and investment in those key areas. For example, Corvidae said, states can create policies that increase demand for clean technology, develop one-stop shop platforms that provide clear guidance on how to navigate the incentive landscape, and convene stakeholders in target sectors where the state can demonstrate the environmental and economic benefits of ‘ a given incentive.

He pointed to South Carolina, and she Special Committee on South Carolina’s Energy Future as an example. The state’s senate committee recently began meetings with the goal of creating a comprehensive bill for the state’s energy policy. (South Carolina is currently at 7 percent of its funding potential, according to the RMI analysis.) Initiatives like these, Corvidae said, can help states think about the possibilities that will allow them to answer one key question: ” How do we organize the state to make sure we capture these dollars?”