In recent years, Mexico has seen a boom in digital banking, with many traditional banks and new entrants offering online and mobile banking services. The rise of fintech companies has also disrupted the traditional banking landscape. These startups offer innovative solutions, including mobile wallets, peer-to-peer lending, and digital payment platforms, that challenge established banking models—and bring banking services to underserved populations, including the nearly half of Mexican adults (pdf) who do not have a bank account.

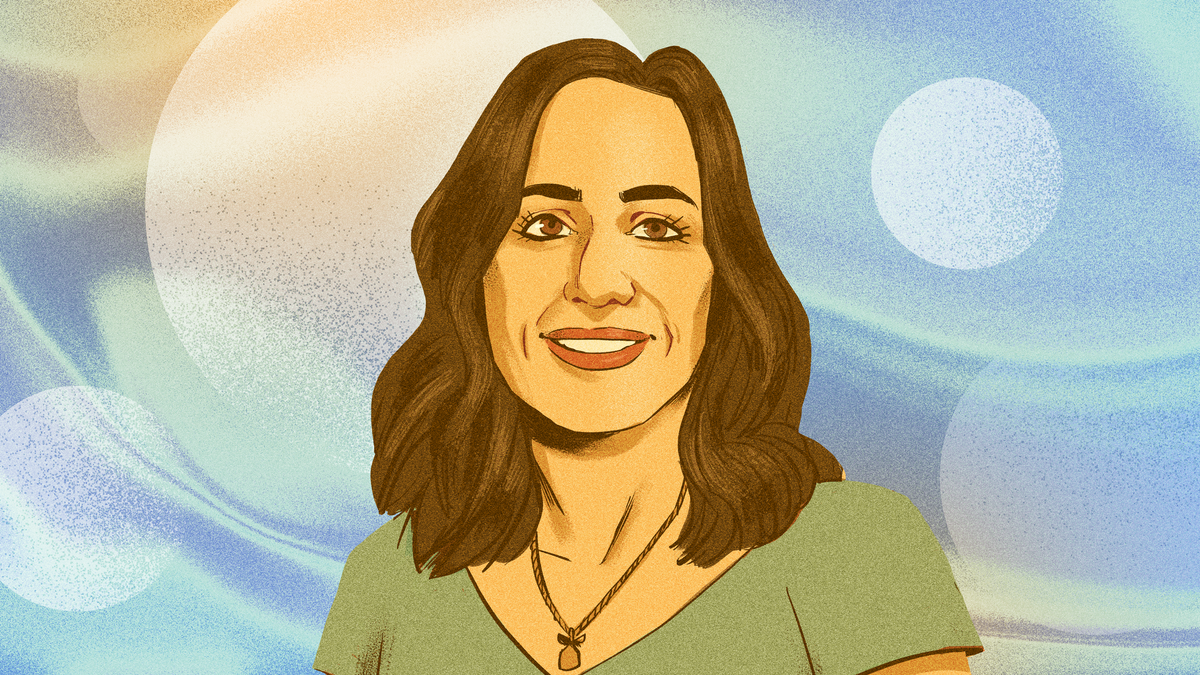

Just ask Cristina Junqueira, one of the main muscles behind Nubanka digital financial services platform that now serves 90 million customers across Brazil, Mexico and Colombia, making it the largest fintech company in Latin America – and now the largest digital bank in the world, period.

The Brazilian native and Northwest MBA left a more traditional (and frustrating) career in high finance to Co-founder Nubank in 2013, drawn to leveling the playing field for everyday people. The result is a line of consumer-friendly products aimed at previously underserved populations.

In the past year, building on Nubank’s popularity in its home market of Brazil, Junqueira has helped launch a new range of products for Mexican clients. “In Mexico, with our digital savings account Cuenta Nu, we have been able to provide customers with innovations that help them make the most of their money,” she explains. Using the digital account, customers can use features like Cajitas—money boxes—to get returns as high as 15% annually.

As Junqueira points out, they are also built to bolster security. “[T]the amount of money invested in it is not shown with the general account balance and cannot be withdrawn in ATMs, nor used for debit card purchases,” she says. After the introduction of savings accounts in May, the bank signed up more than 1.3 million people by the end of his second term.

“It’s innovations like this that help free more Mexicans from financial complexity, and help them regain control of their money,” she adds, “leading to greater responsible financial inclusion in the country.”

This story is part of Quartz’s Innovators List 2023a series that highlights the people who are deploying bold technologies and reimagining the way we do business for good around the world. Get the full list here.